The vast majority of the new administration’s avalanche of Executive Orders and proposed legislation is framed as saving money, potentially billions of dollars. Beyond increasing government efficiency, many suggested or already implemented policies are extreme, such as freezing funds already approved for a multitude of agencies and services. Most of the services targeted are programs for social services, and for vulnerable populations.

The throughline of the administration’s narrative is that anything that is cut from government programs is good for the country, when in fact that is often not the case.

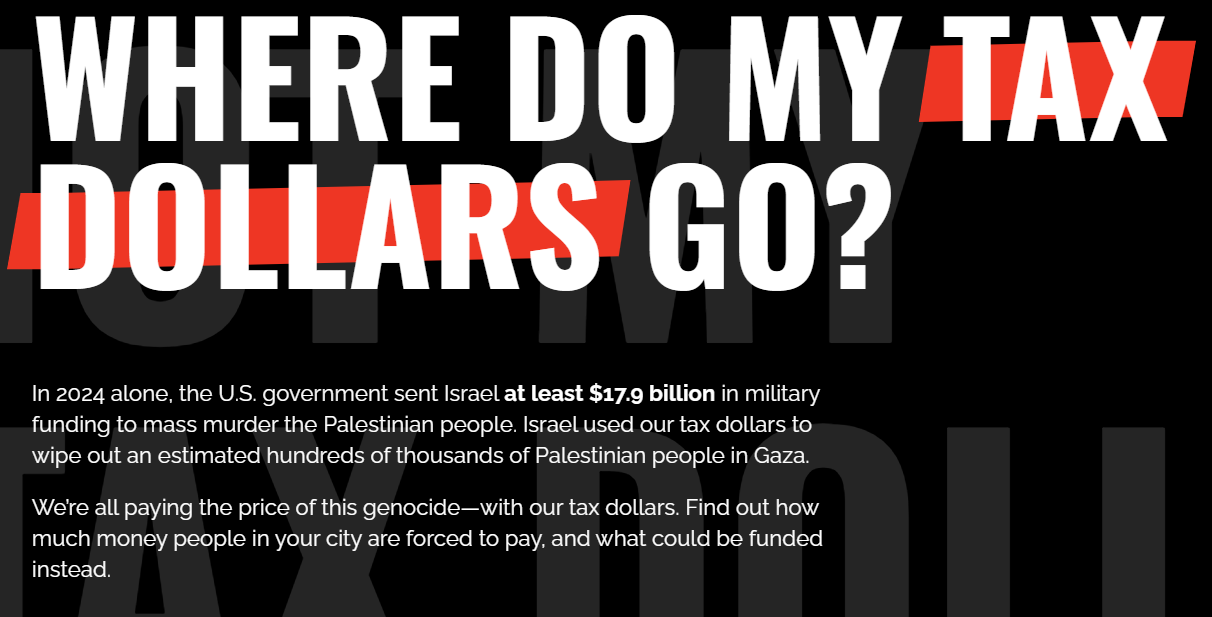

My question is, what happens to those savings? Where does the money go? Who benefits, directly or indirectly? Follow the money.

We can object to many of these policies on the grounds of their impacts on social services or being unjust, but I think that when the public feels the actual negative impact of these policies, that will be far more likely to result in resistance to those policies.

The Trump administration claims policies, such as tax cuts and deregulation, are primarily intended to stimulate economic growth and increase disposable income for individuals and businesses. The administration argued that these savings would lead to increased investment, job creation, and consumer spending, which in turn would boost the overall economy.

However, the actual impact of these policies on the economy and government revenue is a subject of ongoing debate among economists and policymakers. Some argue that the savings have contributed to economic growth, while others contend that they have increased the federal deficit without delivering proportional benefits

This is reminiscent of “trickle-down economics” of years past, which was the same idea, that giving tax breaks to the wealthy would result in job creation and improving the economy in other ways. Which did not happen.

When running for office, President Donald Trump promised to help working-class Americans—people like those I represent in Kansas’ Third District. I share that goal and have worked across the aisle to lower costs for families. That includes reducing the cost of prescription drugs, making groceries and gas more affordable, and rebuilding roads and bridges while creating good-paying jobs.

But the president’s recent executive orders have moved us further from that shared goal. These actions don’t lower costs for hardworking Americans. In fact, many of them will raise costs for families while benefiting special interests and large corporations.

Kansans deserve better. That’s why I’m calling attention to these shortcomings and laying out a path forward toward bipartisan progress that genuinely supports everyday Americans.

President Trump Should Commit to Actually Lowering Costs for Hardworking Families | Opinion by Sharice Davids, US Representative for Kansas’ Third District in Congress, Newsweek, Jan 29, 2025

The article, “What a Trump Win Means for Your Personal Finances and the Economy by Anna Helhoski lists Trump’s campaign promises, and economic analyst’s views about them.

- Inflation. “Inflation, as measured by the consumer price index, has already slowed to 2.4%, well off its pandemic-fueled peak. Trump promised to lower prices and slow inflation, but whether a president can directly do so is less certain.”

- Place tariffs on imports

- Lower gas prices

- Weaken the power of the Federal Reserve

- Cap credit card interest rates at around 10%

- Taxes

- Extend tax cuts in his 2017 Tax Cuts and Jobs Act

- Replace personal income taxes with tariffs

- Lower the corporate tax rate from 21% to 20%

- Implement R & D tax credits for businesses

- No tax on tips

- Health care

- Revisit the Affordable Care Act

- Push for in vitro fertilization coverage

- Leave abortion laws up to the states

- Housing. “Trump’s plans have been sparse when it comes to housing. However, experts say that his plans to deport millions of unauthorized immigrants could drive up housing prices since the construction industry is reliant on immigrant labor. Here are other proposals:”

- Open up federal lands for new housing developments

- Cut red tape

- Student loans

- Curb debt cancellation

- Dissolve SAVE

- Support vocational training

- Mass deportations. “Trump’s plan to deport unauthorized immigrants, en masse, would have unintended, but significant economic consequences including:”

- Increasing costs economy-wide

- Driving up food prices

- Slowing housing construction

I think that when the actual negative impact of these policies is felt by the public, that will be far more likely to result in resistance to those policies.

The President cannot implement some of those proposals, such as lowering gas prices. Some are good, such as supporting vocational training.

What economists say

A letter released on Oct. 23 and signed by 23 Nobel Prize winning economists asserts that Trump’s “policies, including high tariffs even on goods from our friends and allies and regressive tax cuts for corporations and individuals, will lead to higher prices, larger deficits, and greater inequality.” The letter also said that Trump would “threaten” the three determinants of economic success: “rule of law and economic and political certainty.”

The letter was preceded by another letter released on June 25 by 16 Nobel Prize winning economists who wrote that Trump’s economic proposals would lead to inflation and post other risks to the economy. The letter stated “The outcome of this election will have economic repercussions for years, and possibly decades, to come. We believe that a second Trump term would have a negative impact on the U.S.’s economic standing in the world and a destabilizing effect on the U.S.’s domestic economy.”

“What a Trump Win Means for Your Personal Finances and the Economy. Multiple analyses of Trump’s economic plans project that his presidency is likely to reignite inflation” by Anna Helhoski, nerdwallet, Nov 6, 2024